Controversy continues to reign supreme at Absa Bank Kenya even as the lender battles to save face from a myriad of corruption related allegations, money laundering, extortion and intimidation of both junior staff and clients.

The latest casualty of the bank’s unending cat and mouse games orchestrated by some of its senior staff is the sacking of a junior employee by the name Joseph Wafubwa.

Wafubwa has been an employee at the bank’s Nkrumah Road branch in Mombasa.

Both Nkrumah Road and Nyali branches have dominated headlines for the wrong reasons the whole of 2023 and it’s not shocking that an innocent employee has been fired at the expense of senior staff who have schemed all the big money deals.

According to inside sources, Wafubwa was asked to either resign or get jailed forever (intimidation).

This was done by a senior HR staff member who went to Mombasa on different dates in October and asked for Mr. Wafubwa’s resignation.

Read also: ‘Dead man’ withdraws Ksh18.5 million from Absa Kenya

This was in relation to a dubious multi-million money deal planned by senior officers at the branch and some at the bank’s headquarters in Nairobi.

This comes a month after we published how the bank got involved in a Sh10 million fake bank guarantee to a client.

The fake bank guarantee was given to an investor in the oil sector (Shell Petroleum name withheld) who had managed to order goods worth millions of shillings only for the bank to disown the guarantee.

The bank through its Trade and Finance department sent an email to the investor denying the guarantee.

It explained that the guarantee was not binding.

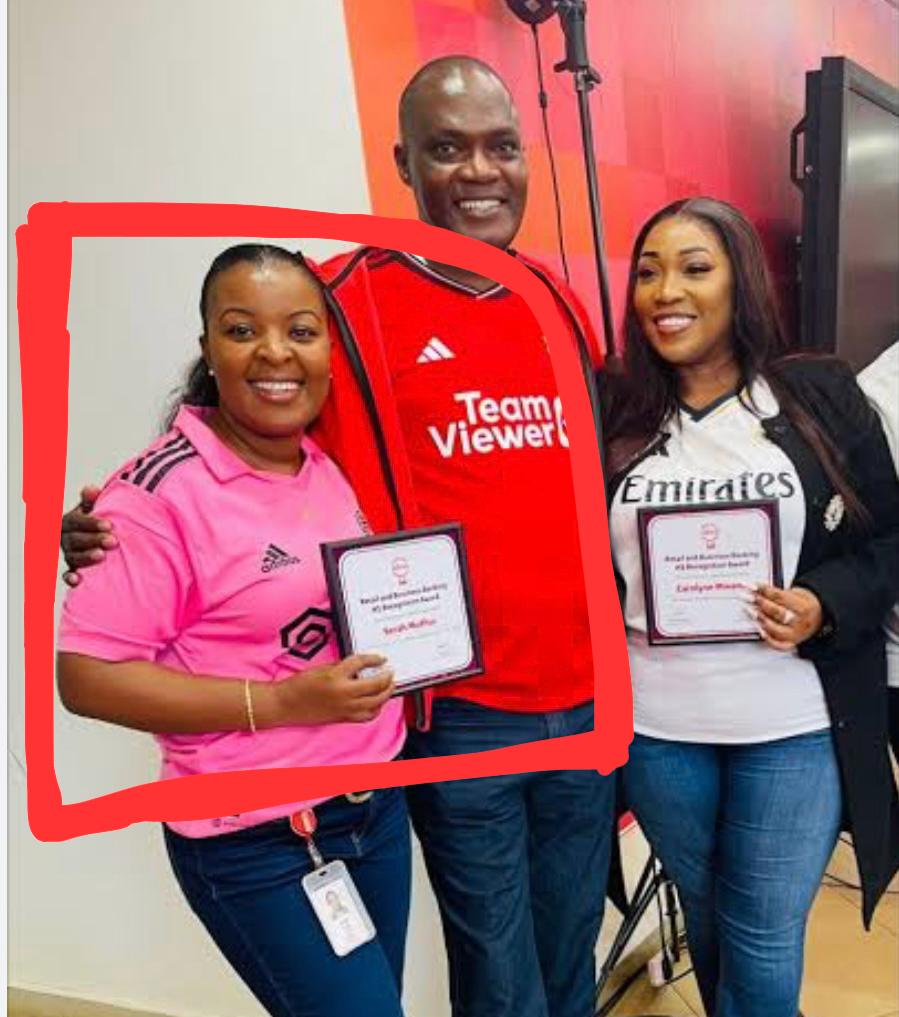

Photo: Controversial and corrupt Serah Muthoi with colleagues.

The guarantee was issued by the Nkrumah Road Branch and the staff who handled the issue was suspended on 13th October, 2023.

The staff happens to be Joseph Wafubwa but our investigation reveal that he was being used as a proxy by some senior staff at Nairobi headquarters some of which have been moved to different sectors to conceal the evidences.

Senior Nyali Absa branch staff, Nkrumah Road staff and other senior officers in Nairobi were involved in the deal.

WhatsApp and email communication in our possession details how other corrupt officers in the bank’s headquarters in Nairobi were also involved and received massive kickbacks from the investor.

The 30% is often shared between the staff and their seniors in the bank and this has reportedly gone on for long because the bank has always been siding with its staff in efforts to protect its image.

The sacking of Wafubwa according to lobby groups pursuing the matter is against the law and want the bank to come out and speak it’s true position on the matter.

Human Rights activist Andrew Mwadibe says the matter requires public scrutiny given Absa’s stake in the country’s financial affairs.

“This is Absa,a bank with an international reputation which means it understands labour laws very well so such a matter needs investigations that go beyond their internal mechanisms,” he said.

Section 44(4) of the Employment Act makes provision on summary dismissal on grounds of gross misconduct.

The employee can challenge the sacking in court under the provision above.

Meanwhile, a public relations firm handling the bank’s media relations has been working hard behind the scenes to stop any negative publicity against the bank.

Despite a public rant by singer Akothee who complained of the bank’s poor customer relations, the mainstream media gave her case a wide berth.

It has to be noted that the bank is still battling a Sh.1.5 billion case against transport firm New Mega Africa.

The firm through its director accused Corporate Credit Manager Supporting Business Banking Wycliffe Makori of working with other employees to share its details with a Kenya National Highways Authority officer identified as Jared Makori.

Mr Wycliffe Makori is now a witness standing in for the bank issued affidavits in efforts to delink himself from the accusations.

In a separate case, the bank on Tuesday January 10,2023, was ordered to compensate a couple more than Sh234 million over fraudulent sale of their shares.

The bank was found guilty of fraudulently selling the couple’s shares in various companies including East African Breweries Plc (EABL) and BAT Kenya.

Photo: From left to right Wycliffe Makori, David, Joseph Wafubwa, Sophie Omondi and a coallegue during a recent Absa party at an eatery in Nyali.

In the case involving Akothee, the bank was put on the spot over suspected collusion between the bank’s staff and third parties, a man accused of stealing Sh717,111 from the Absa Bank account held by Aknotela Limited was in August charged before Milimani Chief Magistrate’s Court.

The withdrawals by Simon Kipngetich Tonui happened on various dates between August 7 and September 15, 2023.

He is facing 12 counts of stealing contrary to the law even as Aknotela Limited remains suspicious of the bank’s staff having colluded with Simon.

Absa in March disclosed spending Sh1 billion on court settlements in the financial year that ended on December 31, 2022.

The figure is expected to be bigger for the year ending December 31, 2023.

As if that is not enough, we are also in possession of details linking a senior staff at Absa Nyali for colluding with some other police officers to harass a car wash attendant at National Oil along Links road.

The officers according to documents in possession were issued verbal communication where no proper summons were done.

The Nyali absa staff has only been identified as Serah Muthui, she harassed a car wash attendant over some fault in her car KDC 004B. Muthui is said to have used derogatory and intimidating words against the innocent attendant.

According to police and bank sources who sought anonymity added that the matter will soon attract IPOA and human rights activists.

“It is very wrong to use rogue officers to intimidate a hustler. We are keenly following up the matter. Actually the life of that boy is in danger. We re monitoring the situation very closely.” She said

This comes at a time when some of the bank’s customers have poked holes in the new digital solution platform unveiled by the bank.

The financial institution says that the new platform will offer banking, savings, and payment services.

Absa Managing Director Abdi Mohamed said that the solution will allow those in the diaspora to invest in local projects.

However, some clients are a worried lot and cautious enough to engage the bank through its digital platform over the ongoing data breach case the bank is battling in court.