Absa bank is still battling a myriad of cases from its customers, mostly organisations and institutions banking with the bank.

The bank is battling serious allegations allegations of staging fake events and blantant misuse of public resources.

The bank is already involved in a myriad of court cases related to fraud.

The management of the bank was thrown into turmoil and disarray after a former staff swore affidavit implicating the bank for data breach.

In an affidavit dated 6th December,2023 the public was greedy to a seies of events that directly linked a current senior officer and the management of the bank to a data breach involving transport firm New Mega Africa.

The affidavit was sworn by Evans Murumba who served at the bank as the sector Head, Business Banking where he wants to be involved as an interested party in the Sh 1.5 billion compensation suit by New Meg Africa.

“A source within the bank said that the bank is in turmoil, after realizing that the forensic team and investigators it hired to probe the matter was most likely compromised by the besieged staff who orchestrated the matter.

In the affidavit, Murumba disclosed that he had an employment contract with the bank between April 2019 to June 2022 when tendered his resignation to venture into politics.

His work included overseeing the Bank / Client relationship with clients where he admits he had several engagements with New Mega Africa and the bank’s senior officials at the Coast.

At the centre of the fierce court battle between the bank and New Mega Africa is the bank’s Credit Manager Wycliffe Makori whom the firm’s director David Abai is blaming for data breach, blackmail and frustration.

Murumba had been mentioned in the case as having been a beneficiary of the alleged scheme to extort Abai who was battling to save New Mega Africa from running out of business.

He claims that he is aggrieved by the allegations made in the suit casting aspersions on his character, integrity and professionalism.

He admitted that he is the one who convinced New Mega Africa to obtain a loan facility from the bank.

“That in the course of my duty, I sought to convince the plaintiff to commence a banking relationship with the Defendant, during which various credit facilities amounting to Ksh,72,000,000 which was advanced to the plaintiff based on my recommendation,”

He further confessed to have known New Mega Africa from his previous employment with Stanbic Bank where the firm was banking and he got to know the Director, Mr.David Abai who was also well known to him owing to the extensive relationship that existed between the firm and Stanbic Bank.

In his affidavit, he confessed that during his tenure in employment with the bank, New Mega Africa operated its credit facilities very well to the satisfaction that on various dates, additional credit facilities were recommended.

“That at the height of Covid 19- the plaintiff was having a lot of transportation work of clinker to Toronto cement Uganda for Mombasa Cement sister company Toronto who had contracted the client and even gave him 11trucks on lease to own basis Upon the increase of the fleet,the plaintiff wrote to the Defendant informing him of the extra need and how they were planning to handle the new growth in business. This was well within the collateral provided since it was more than adequate to accommodate the facility,”

He revealed that at the plaintiff had the secured a bank guarantee line in favor of Premium energy Ksh 5million.

“Unfortunately,he had been able to draw down the guarantee since there had been a change in payment period by Tororo cement from 7-14 to 45-60 days which premium energy was not agreeable to.He Returned the guarantee to the bank,” he adds

He argued that the bank gave him temporal overdraft line as he looked for a suitable supplier who would not only take the guarantee on the new terms but also give him an extra limit of 5 Million to caution him in the short-run

He added that he received a call from the Coast Regional head of retail banking who confirmed to have talked to the owner of premium energy who he confirmed had agreed to the new terms of New Mega Africa and was willing and ready to extend the extra Sh 5 Million limit to the firm.

“That on the date of said meeting, the client came to the bank’s Nyali office where i was and we called the Regional Retail manager who never answered and thus the meeting failed leaving the client exposed,” he continues

He claimed that at this point New Mega Africa requested for extension of its temporal overdraft line for a further 90 days to enable it to stabilize his business and resolve the deficit.

This request would later be differed as per the email written to the firm by Wycliffe Makori- Credit admin in early August 2021.

He further submits that out of this frustration the firm wrote to the bank to consolidate all its facilities to one term loan aligning to the one with the longest remaining repayment period.

This is where the whole circus of drama with many push and pull games begun as per Murumba’s affidavit

“That i requested the bank’s Credit Manager Wycliffe Makori-to prepare a Credit proposal seeking for the restructure and submit it for approval. In the meantime, I requested the firm to liaise with Wycliffe and furnish him with all the information required.

He said that in one of these meetings they had at the firm’s office seeking to address the delays in getting the restructure approved, a meeting attended by himself, Wycliffe and the Relationship Manager, they discussed a variety of issues affecting the business with the firm emphasizing on the urgency to get approval to avert further impact on its business.

“We committed and agreed to get the approvals done by the next 7 days,”.

It is at this point that he would later learn of something usual that leads to data breach as per his affidavit

“That about one hour after ending our meeting, Mr. David Abai called informing me that a gentleman by the name Jared Makori who was then known to him and was the Regional Manager KENHA had called him with some astonishing need informing him of an unsolicited telephone call by Mr. Wycliffe Makori which was made to him informing him of the financial despair that New Mega Africa has gotten into and that the Bank was considering calling up all the facilities and auctioning the securities,” Evans confirms

He said the purpose of the call was to warn Jared against any potential financial dealings with the firm or its Director Mr Abai Wycliffe further advised Jared to inform all the other friends or businesses who would potentially enter into any financial dealings with the firm to exercise extreme caution.

Staff fallout at Absa Bank emerges as bank battles court cases

Absa Bank Kenya is battling to mute a staff fallout in regard to various mismanagement accusations the bank is facing.

The bank has been battling various accusations fromclients clients in most of its branches across Kenya and Africa at large.

Data Breach accusations and manipulation of clients cases have for the last two years docked the bank.

Senior Officers who have been involved in fraudulent activities are fighting for their jobs after allegations of their heinous crimes became part of high ranking conversations at the bank’s continental headquarters in South Africa.

The Kenyan bank unit has been under tough scrutiny after the revelations of Sh107.7 million loss the bank suffered in 2022.

The bank has been struggling to save face from Public scrutiny after this scandal was widely published.

The bank said its internal interventions to minimise the fraud risk led to a recovery of more than half of what it lost, after it brought back Sh59.1 million in recoveries.

“Fraud remains a major challenge for the financial sector in Kenya. In line with trends observed in 2021, fraud continues to evolve rapidly and match the increased preference by customers for digital propositions,” Absa noted in its inaugural sustainability report,” a senior bank official said then

The bank has been at the centre of allegations of criminal digital banking activities involving staff.

Despite undertaking an employee awareness campaign, a fallout within the staff unit has impeded the initiative.

The bank in 2022 enrolled atleast 1,277 staff to a fraud training session to help support and enhance their capacity to respond respond to such cases.

The training involved aspects of management, prevention, detection, response and trends. In total, 18 training sessions were conducted.

The bank’s senior staff at the Nyali Absa branch have been on the spot over suspect money laundering deals, threatening of staff and hacking of bank account.

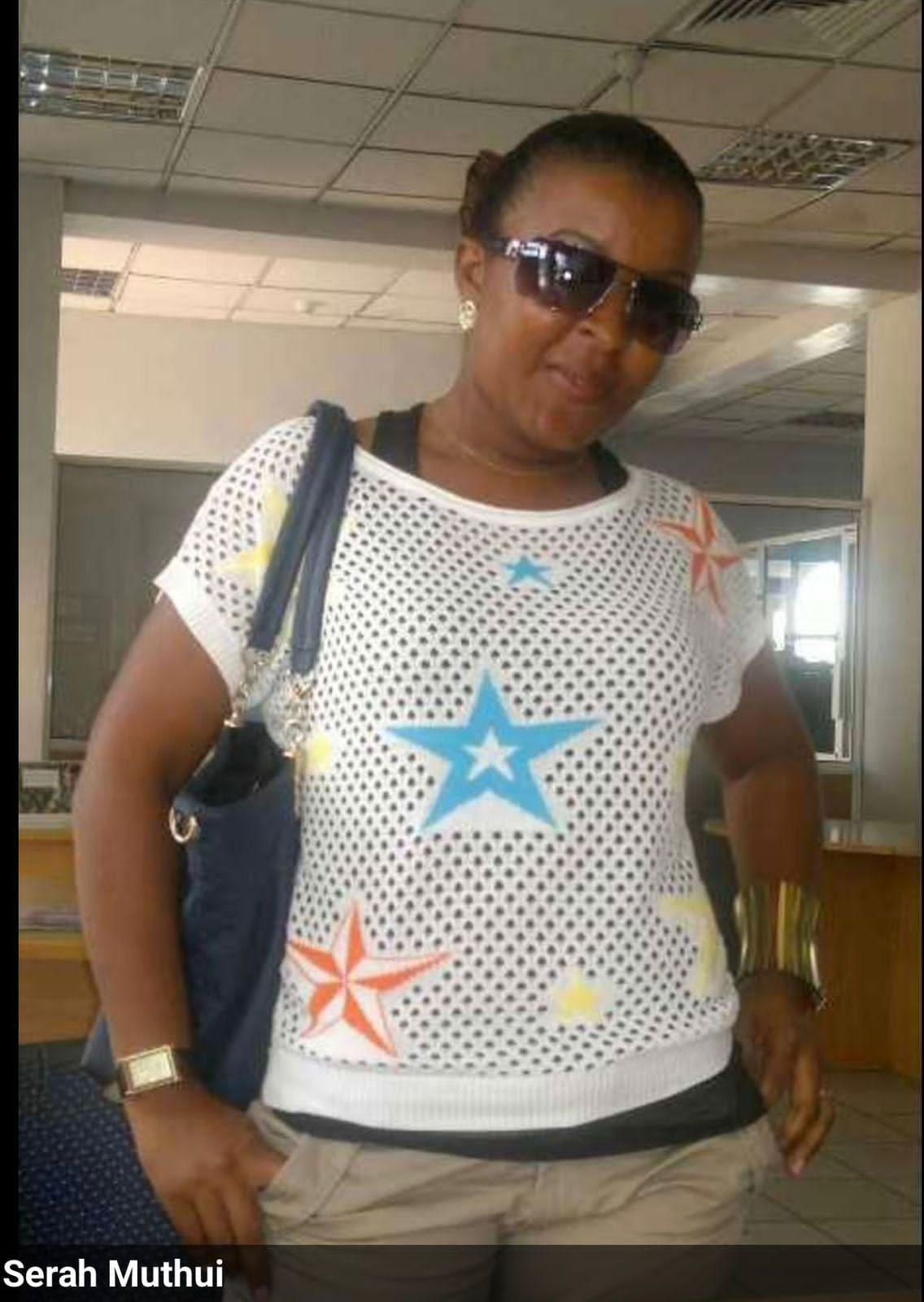

And she has been identified as Serah Muthui who normally uses derogatory and intimidating words against the innocent attendants.

According to reports in our possession the bank staff has been involved in numerous corruption and money laundering dealings at the bank and she doesn’t care.

“She says that she is connected and she doesn’t fear anyone, she uses witchcraft and easily lures men to bed.” Said a female source at the bank.

“It is very wrong to use rogue officers to intimidate a hustler. We are keenly following up the matter. Actually the life of that boy is in danger. We re monitoring the situation very closely.” She said

A section of the bank’s customers have poked holes in the new digital solution platform unveiled by the bank.

Some junior staff have alleged that the senior staff are unveiling new strategies aimed at defrauding the bank.

The bank’s senior management is currently battling a serious case in which a former staff swore affidavit implicating the bank for data breach.

The damning affidavit dated 6th December, 2023 details a series of events that directly links a current senior officer and the management of the bank to a data breach involving transport firm New Mega Africa.

The affidavit was sworn by Evans Murumba who served at the bank as the sector Head, Business Banking where he wants to be involved as an interested party in the Sh 1.5 billion compensation suit by New Meg Africa.

A source within the bank said that the bank is in turmoil, after realizing that the forensic team and investigators it hired to probe the matter was most likely compromised by the besieged staff who orchestrated the matter.

In the affidavit, Murumba discloses that he had an employment contract with the bank between April 2019 to June 2022 when tendered his resignation to venture into politics.

His work included overseeing the Bank / Client relationship with clients where he admits he had several engagements with New Mega Africa and the bank’s senior officials at the Coast.