Cytonn Investments has today released its FY’2020 Insurance Sector Report, which ranks Liberty Holdings as the most attractive Insurance in Kenya, supported by a strong franchise value and intrinsic value score.

The franchise score measures the broad and comprehensive business strength of Insurance across 8 different metrics, while the intrinsic score measures the investment return potential.

The report analyzed the FY’2020 results of the listed Insurances excluding Kenya Re.

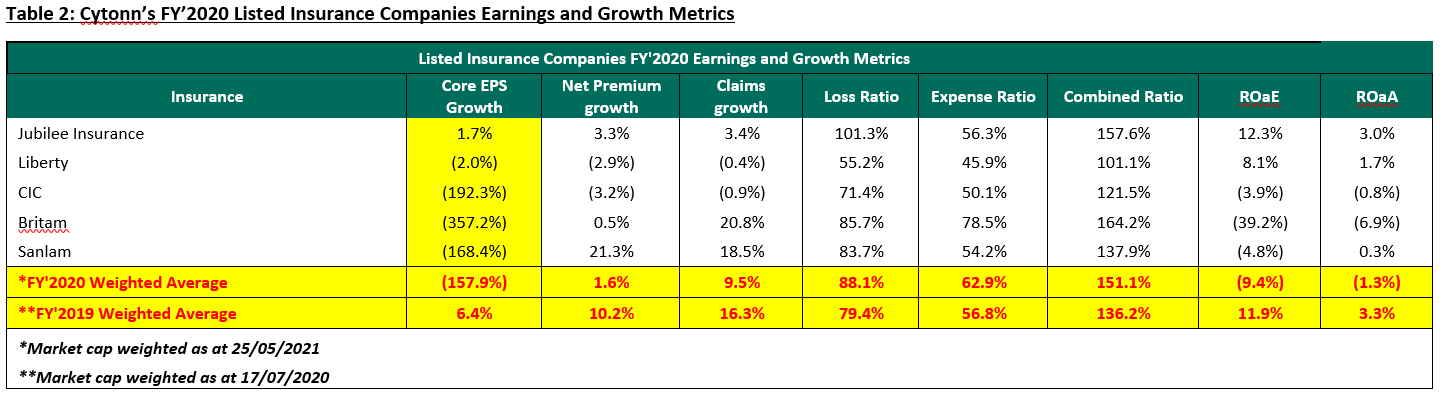

“The Net Premiums grew by 1.6% in FY’2020 which was slower than the 10.2% growth in FY’2019 mainly due to the coronavirus-induced downturn in the economy, which led to reduced disposable income leading to people prioritizing other activities over insurance premiums.

The Loss and Expense Ratios deteriorated and consequently the Combined Ratio also worsened to 151.1% in FY’2020 from 136.2% in FY’2019. The sector was suffering from declining penetration even before the pandemic and this was worsened by the interruptions caused by the pandemic. However, the sector continues to undergo transition where traditional models have been disrupted, mainly on the digital transformation and regulation front.

We expect a moderate growth in premiums as underwriters come up with products suited to the pandemic period mostly in the medical and life businesses. On the other hand, the recovery and opening up of logistical barriers currently at play will see an increased uptake of motor vehicle and marine insurance. We also expect that there will be increased regulation in the sector as insurers adjust their insurance contract recognition methods in preparation to the coming into effect of IFRS17 in January of 2023 or earlier. ” said Ann Wacera, Investment Analyst at Cytonn Investments.

“We expect continued partnerships with other financial services players including Fund managers who have ventured into offering insurance linked products as well as the current bancassurance relationship with Banks. Insurance companies will still want to leverage on the penetration of bank products to also push insurance products. We also expect most underwriters to consider growing their investment income through diversifying their investments by moving to some non-traditional asset classes, necessitated by the slow growth in premiums against an increase in underwriting expenses.” said Solomon Kariuki, Analyst at Cytonn Investments.

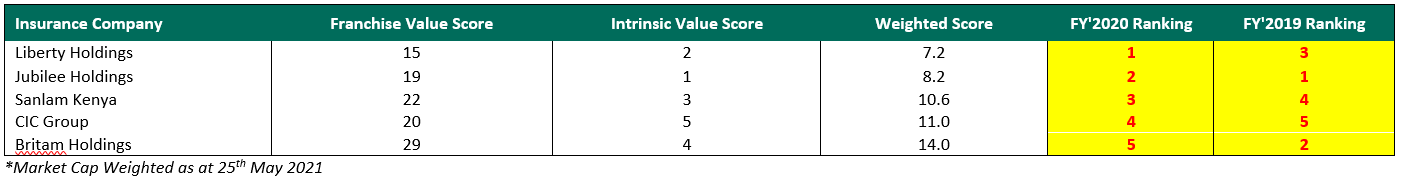

Liberty Holdings improved to position 1 in FY’2020 from position 3 in FY’2019 mainly due to improvements in the franchise score following their resilient earnings in FY’2020. Jubilee Holdings rank declined to position 2 in FY’2020 from position 1 in FY’2019, on the back of a weak franchise score, driven by the deterioration in its Loss and Expense ratios. Sanlam Insurance improved to position 3 in FY’2020, from position 4 in FY’2019 mainly due to improvements in both the franchise and intrinsic value scores. CIC Group improved to position 4 in FY’2020 from position 5 in FY’2019, mainly due to an improvement in franchise scores, as the expense and returns on equity remained unchanged. Britam Holdings whose rank declined to position 5 in FY’2020 from position 2 in FY’2019, on the back of a weak franchise score, driven by the deterioration in its expense ratio to 78.5% in FY’2020 from 62.2% in FY’2019.

Table 1: Listed Insurances Franchise and Intrinsic Ranking

The table below ranks Insurances based on franchise and intrinsic ranking which compares metrics for efficiency, growth, and profitability, among other metrics.