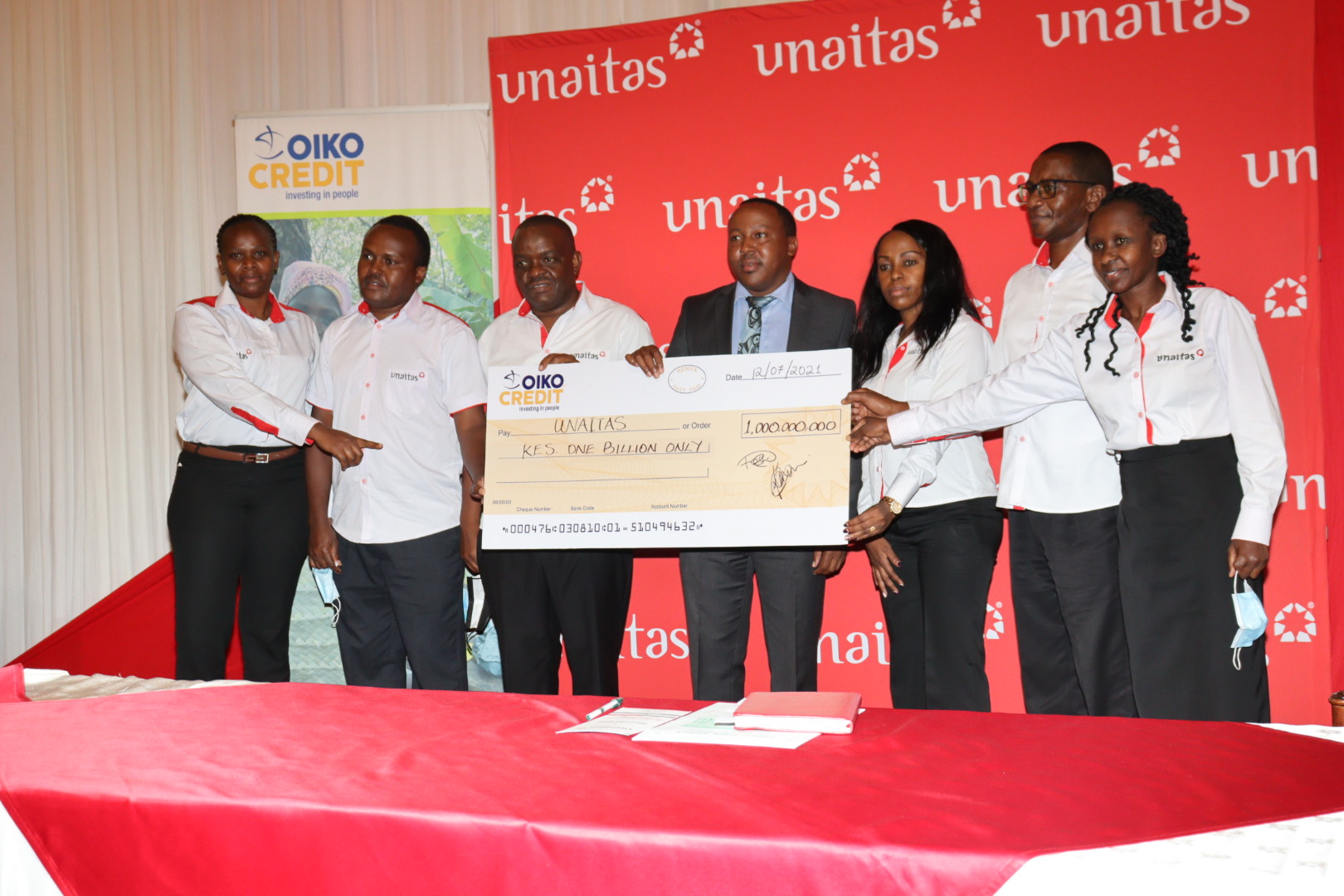

Oiko Credit has partnered with Unaitas in Funding of Small and Medium Enterprises.

This is through KES 1 billion, “Oiko credit is putting its money where its mouth is. UNAITAS is a deserving partner, and we are proud to participate in the formation of the UNAITAS SME Support Fund.

Together, we are fully committed to improving financial inclusion in an underserved market.” Oiko credit is a social investor and world-wide cooperative, with over forty- five years of experience funding organizations active in financial inclusion, agriculture and renewable energy.

We provide various financial products and services such as loans, equity investments and capacity building, with the aim of enabling people on low incomes in Africa, Asia and Latin America, sustainably improve their living standards.

We do this by working closely with institutions in our focus sectors, and providing much needed growth capital, to enable them to achieve their mission. Oiko credit finances 544 partners, with total outstanding capital of € 856.3 million (at 31 March 2021).

In Africa, we have over 100 partners with an active portfolio of €180m. UNAITAS has been a partner of Oiko credit since 1997 when the savings cooperative borrowed USD 370,370.

Since then, UNAITAS has grown in leaps and bounds, and we are proud to be associated with this growth. From humble beginnings as a tea farmers’ savings and credit cooperative based in Murang’a, UNAITAS has expanded to include members that are involved in various other value chains, as well as small businesses, by expanding their product range to suit their market.

Today, UNAITAS can be equated to a bank, while yet holding close to the heart, its strong cooperative DNA that endears it to its members. UNAITAS provides a broad range of services, with varied service channels offered through partnership with commercial banks.

Further, the Sacco is regulated by the industry regulator, and has strong governance and financial management ethic. Their unapologetic focus on smallholder farmers, low-income housing and small and medium enterprises, resonates with Oiko credit’s mission of providing financial access to vulnerable households and supporting employment generation.